With the help of the powerful business management platform Odoo ERP software, Banibro excels at improving financial management. Banibro provides proficient integration and automation for financial workflows, specializing in Odoo’s accounting and finance modules. Our services include accurate expense tracking with Odoo ERP, streamlined invoicing, and effective bookkeeping, all of which combine to create a complete financial management system. Through the customization of Odoo ERP to specific business requirements, Banibro enhances the accuracy and efficiency of financial operations. Accept the power of Banibro in conjunction with Odoo ERP software for your accounting and finance requirements, guaranteeing an advanced and scalable method of handling business funds. Utilize Odoo ERP and Banibro’s combined strengths to improve your financial processes.

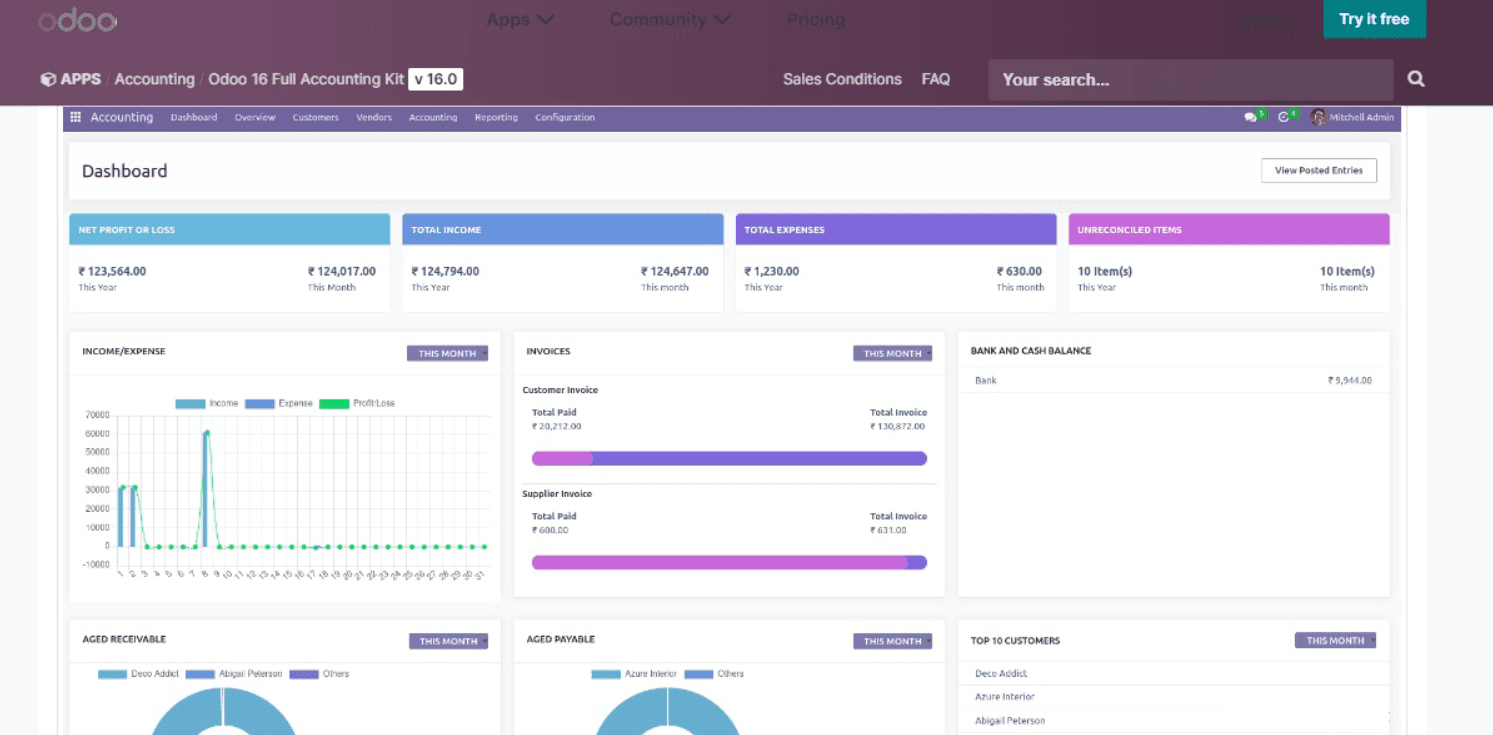

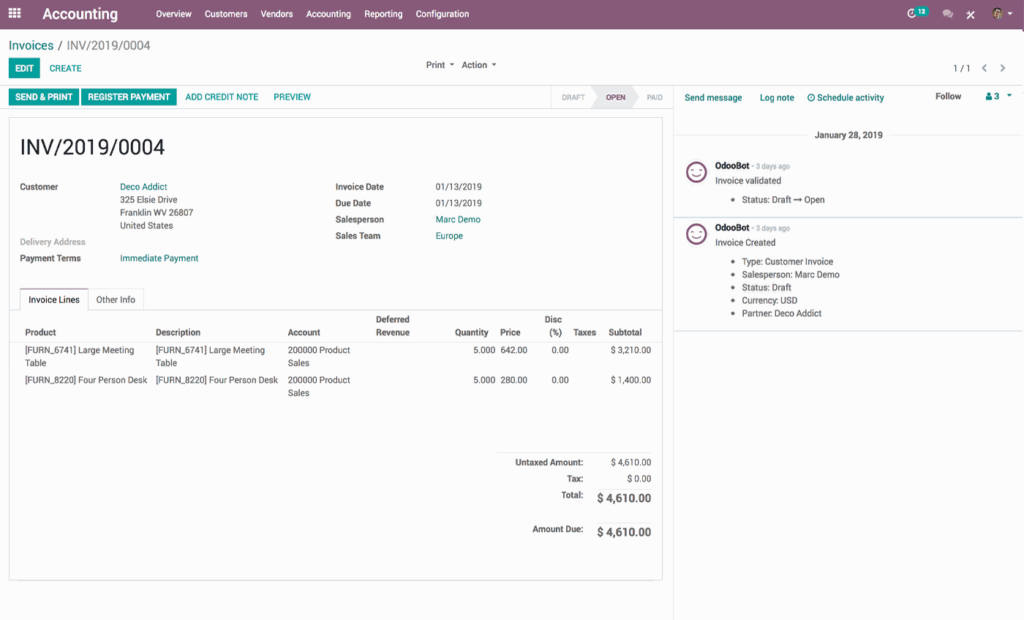

Streamline financial operations, track transactions, and ensure accurate reporting with our Accounting module for finance ERP

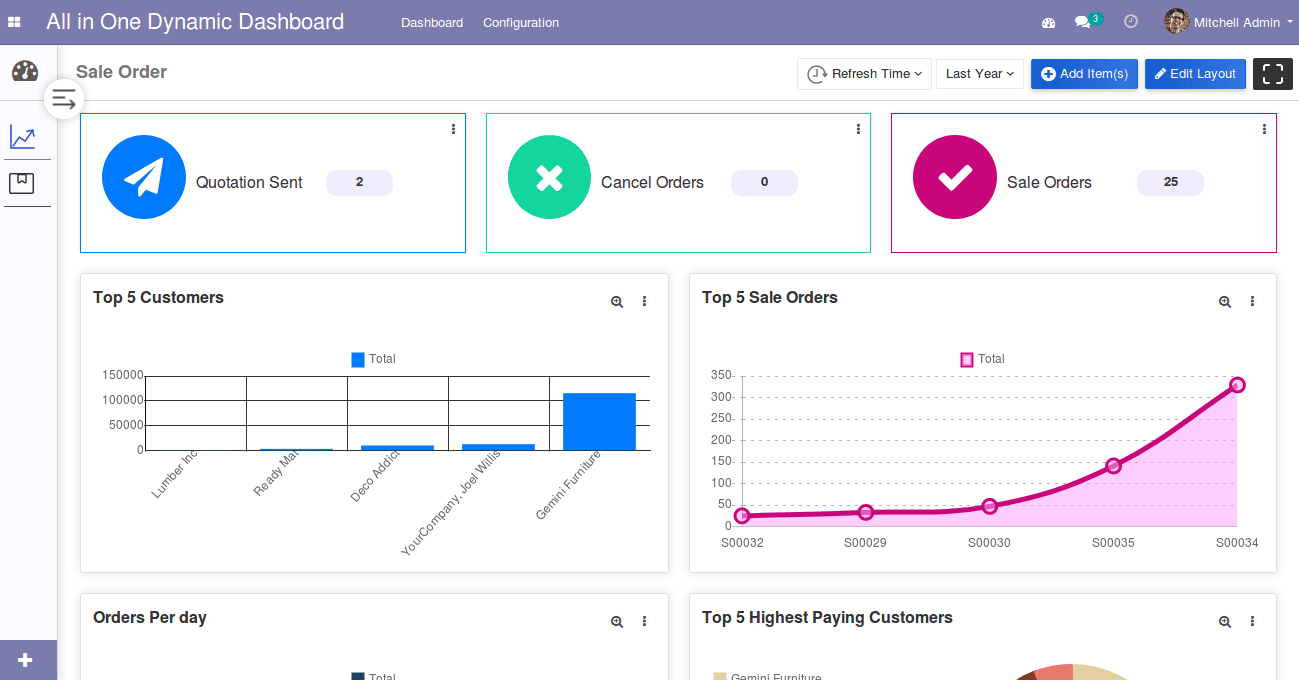

Gain real-time insights, monitor key metrics, and make data-driven decisions with our Real-time Dashboard module for finance ERP

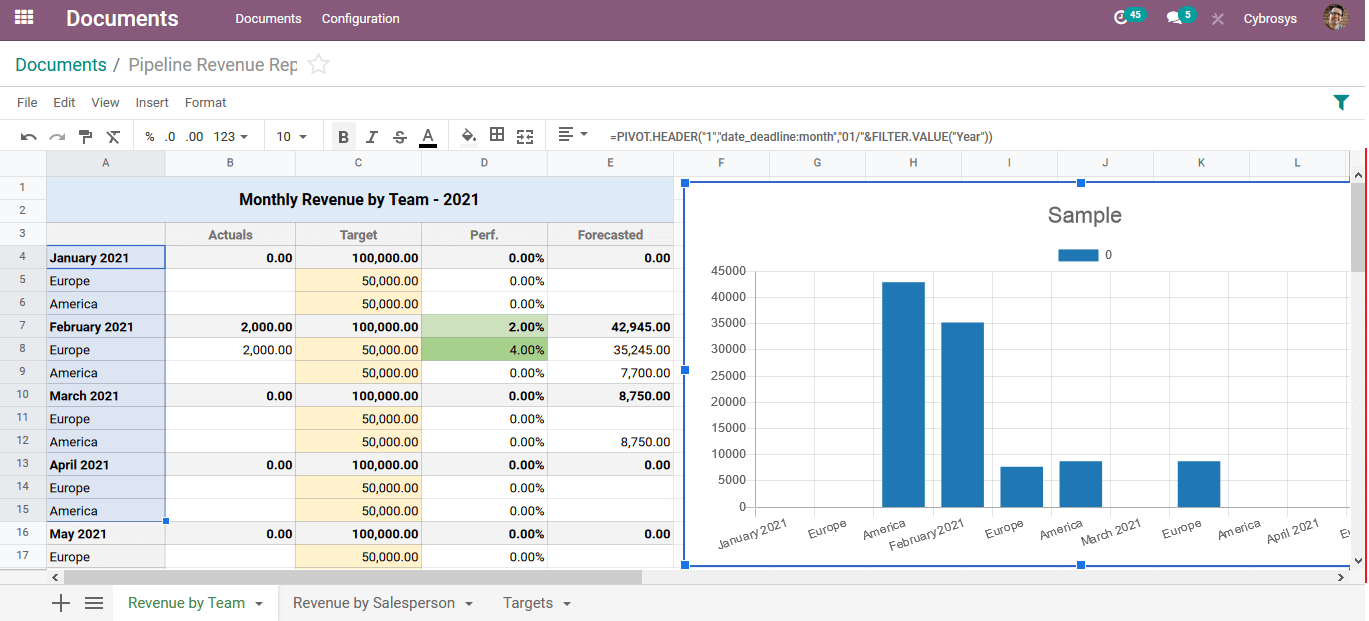

Access comprehensive analytics, generate advanced reports, and drive informed decision-making with our Advanced Reports module for finance ERP

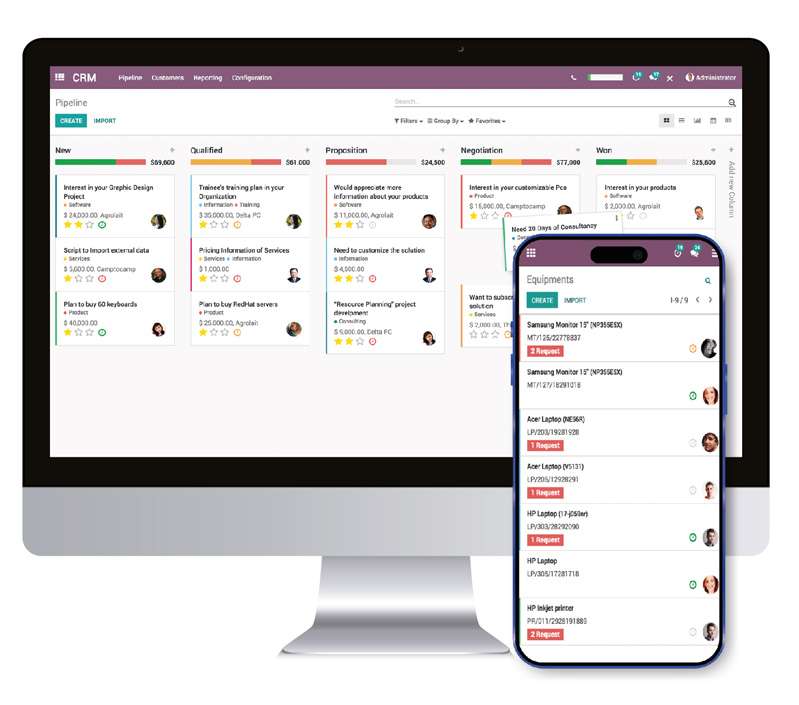

Seamlessly integrate with external systems, enhance data exchange, and optimize workflow efficiency with our Integration module for finance ERP

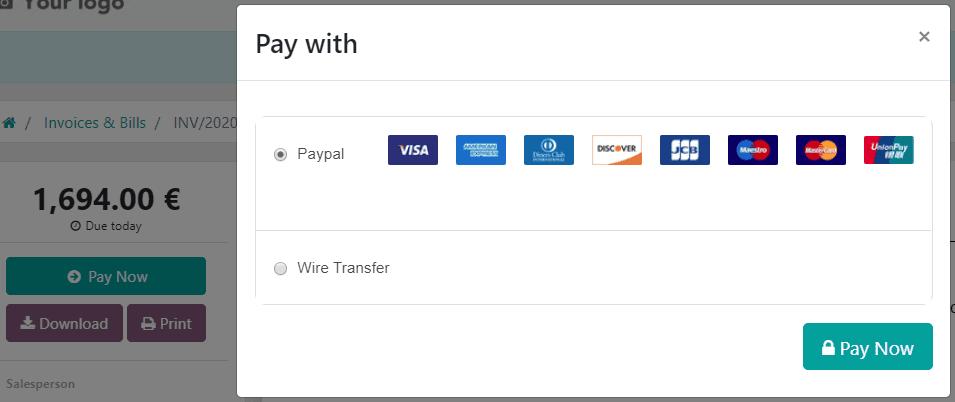

Automate billing processes, generate accurate invoices, and streamline financial transactions with our Invoicing module for finance ERP

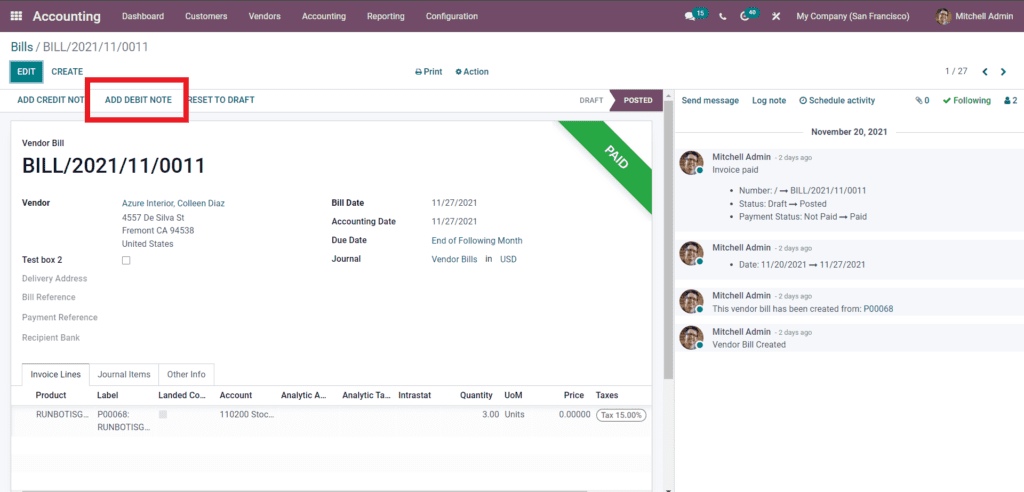

Efficiently manage debit/credit transactions, track balances, and ensure accurate financial records with our Debit/Credit module for finance ERP

The finance modules in an ERP system typically include general ledger, accounts payable, accounts receivable, cash management, budgeting, and financial reporting.

An ERP system handles financial data by collecting, storing, and processing data related to financial transactions, invoices, payments, and other financial records. The system ensures that all financial data is accurate, up-to-date, and accessible to authorized users.

An ERP system can improve financial management by providing real-time visibility into financial data, enabling faster and more accurate financial reporting, automating financial processes, reducing errors and fraud, and improving compliance with regulatory requirements.

The key features of a finance-based ERP system include customizable dashboards, financial reporting and analytics, multi-currency support, automated invoicing and payments, audit trails, and integration with other financial systems and tools.

The implementation timeline of an ERP system depends on various factors, such as the complexity of the system, the size of the organization, the number of users, and the level of customization required. On average, it can take anywhere from several months to a year or more to implement an ERP system.

To select the right ERP system for their finance needs, an organization should consider factors such as their business requirements, budget, scalability, integration capabilities, user-friendliness, and vendor support. It’s also essential to conduct thorough research, evaluate multiple vendors, and request demos and trials before making a final decision.

Some common challenges associated with implementing an ERP system include resistance to change from employees, data migration issues, lack of training and support, unexpected costs, and difficulties in integrating the system with existing software and tools.

Yes, most ERP systems offer customization options to tailor the system to an organization’s specific finance needs. However, customization can increase implementation time and cost, and may also require ongoing maintenance and support.

Cloud-based ERP software is a type of ERP system that is hosted in the cloud, which means it’s accessible via the internet and doesn’t require any on-premise hardware or infrastructure. Cloud-based ERP systems are typically more flexible, scalable, and cost-effective than traditional on-premise systems, and also offer greater mobility and accessibility.

AI can be used in finance-based ERP systems to automate routine financial processes, such as invoicing and payment processing, reduce errors and fraud, provide predictive analytics and forecasting, and enable faster and more accurate decision-making.